According to the report released by the CryptoCompare Exchange Review, crypto derivative and options trading saw a double digit decline, reaching the lowest monthly volume of 2020.

Both cryptocurrency derivatives and option trading have been hit hard in June. Derivative sales volume dropped 35.7% to $393 billion last month and recorded the bottom of 2020. Total spot sales volume reached $642 billion, down49.3%.

However, let us state that there is an increase in the market share of derivatives despite decrease in volumes. While the derivatives market share was 32% in May, this ratio increased to 37% in June.

Crypto derivative volume at the lowest level of the year

According to the report prepared by CryptoCompare, all derivative exchanges saw large decreases in transaction volume in June. BitMEX, which experienced the biggest decrease, fell below $52 billion with a decrease of 50.3%.

Despite a 38.3% decline since May, Huobi remains the largest derivative exchange with $122.4 billion. OKEx ranks second with a volume of $ 106.9 billion. The popular exchange fell 30.4% compared to May. Binance follows with $85.9 billion. Binance’s volume fell by 34.2%.

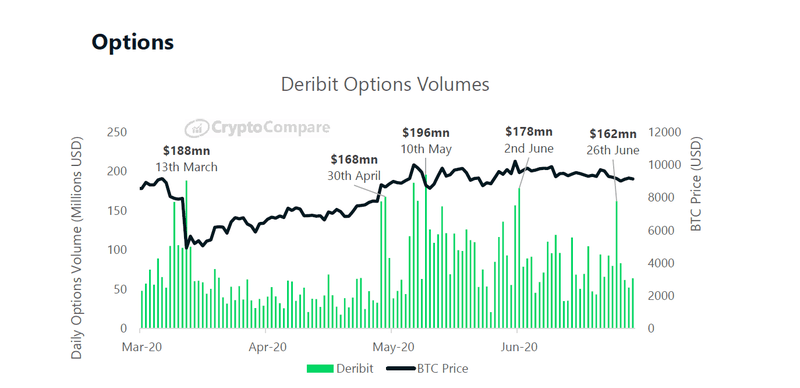

Option trading declined slightly

Option trading also saw a sharp drop this month, though it was less severe than the derivative market. The report stated that Deribit’s monthly option volume decreased by 17.8%.

Daily options trading witnessed two major highs of $178 million and $ 162 million, on June 2 and 26. The report claims that these tops are comparable to daily records created in previous months.