Bitcoin price, which fell below $9,000 on Sunday and frightened investors, followed a rapid recovery afterwards. It was clear that this decline was a bear trap, as the cryptocurrency climbed to $9,400 in 48 hours. At the time of writing, BTC is trying to break the $9,300, showing a bullish momentum.

CJ: “Bitcoin price will start rising soon.”

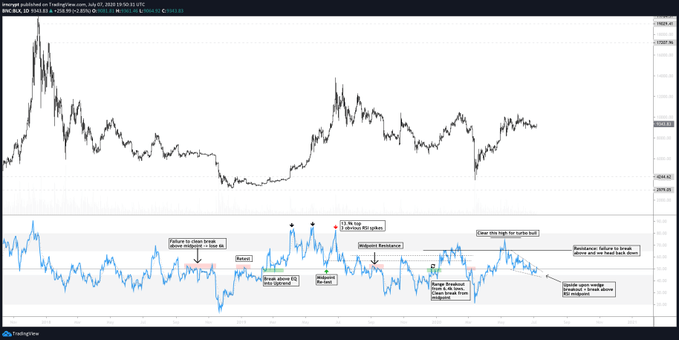

Although the cryptocurrency is not yet above the critical resistance zone in the range of 9,400-9,500, the break will happen very soon, according to an analyst. The analyst with the nickname CJ on Twitter, claimed that the relative strength index lies behind this bullish momentum. According to the technical indicator shared by CJ, the RSI rises above significant levels and the BTC price will rise rapidly soon.

Sharing the chart below, CJ shows that Bitcoin’s one-day RSI indicator has passed through the falling wedge. The falling wedge is known as a bullish chart structure that can be seen near an asset’s bottom or in a bullish trend. We should also be noted that the RSI exceeds 50 levels.

Analysts are also thinking that there are other indicators for the bullish trend of Bitcoin. One of the clearest signs is the funding rates of futures markets. Funding rate means the fee paid by long position holders to short holders to pull the futures price to the index price.

The funding rate is neutral at the time of writing this news.

It seems that this macro news moves in parallel with the technical indicators. FTSE’s China A50 index rises to an all-time high on the first day of this week. During this trading session, the index experienced 6% rally, one of the best performances. Analysts see this trend as a steady rise for the crypto market, which has become associated with global exchanges.