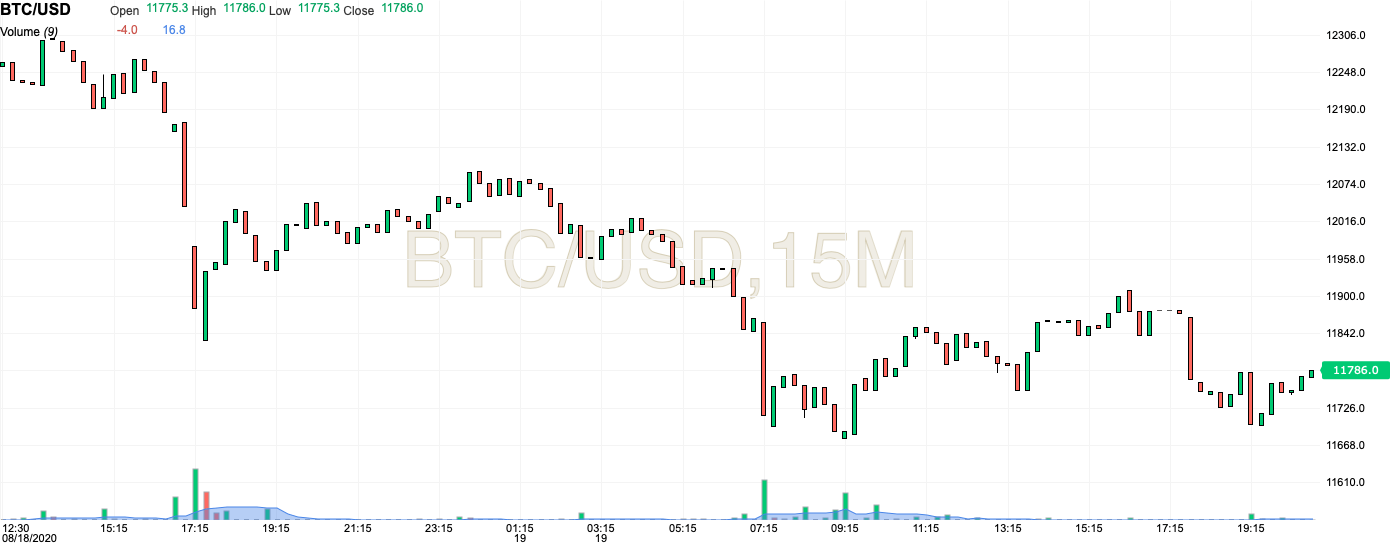

Bitcoin, which has shown a very stable performance recently, has dropped more than 2 percent in the last 24 hours, falling below $11,750. Suspicions about the bears’ return grew. So is the bull market going on? Or will the fall gain depth?

We see that there has been a more active and positive period for Bitcoin compared to the previous months in August chart. While $10,000 has acted as a psychological limit since March, Bitcoin has moved this threshold to $12,000 with a good performance. This level, which had been violated four times since the beginning of August, was broken as of August 17.

However, Bitcoin has lost its power in the last 24 hours. After a strong decline, the price dropped below $11,750.

Traders point to the $10,000

Meanwhile, some popular investors and cryptocurrency reports also think that the next step for Bitcoin could be the $11,000 and $10,000 levels.

OKEx’s on-chain data shows that $10,000 will serve as a very strong support level, Cointelegraph reports. In the report, which stated that positions at the level of $6,200 and $9,700 will play an important role, it is said that the strength of $10,000 cannot be denied in the long term.

Optimism in the long run for Bitcoin

The $11,225 level will serve as a very strong support, according to Coinspeaker analysts. Bitcoin could test here in the short term. After that, it can return to $12,495 once again. However, it is worth noting that this scenario will be canceled if $11,150 is broken. A break here could lower the price to $10,500.

On the upside, we can say that the $13,800 seen in January 2019 can act as a resistance. Yet what will happen remains a mystery. Because it is obvious that Bitcoin has not managed the crypto market in recent days. Although BTC moves with the global markets with a unique approach, it is necessary to closely track the fate of the DeFi market.