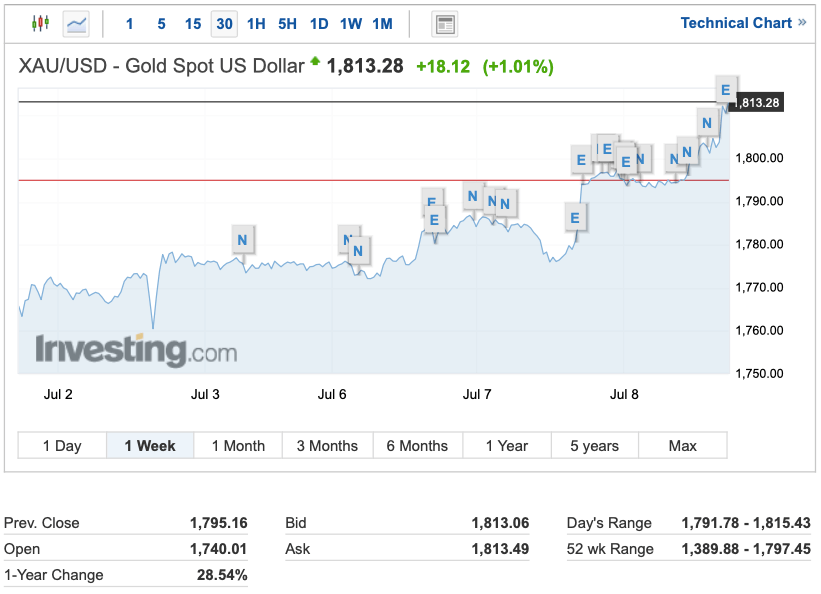

Gold, the best representative of the “safe haven” narrative in the financial world, has recorded one of the biggest bull runs in its history since March. Precious metal, which gained 30 percent in the last four months, has exceeded $1,800 for the first time. Will bitcoin follow real gold?

When we look at the historical graph of gold, we see that a U shape has been drawn in the last ten years. This trend, which started in 2011, is crowned with new records by 2020.

It is known that Russia and China purchase large amounts of gold. Russian President Vladimir Putin, who was involved in this trend in 2018, seems to be finally getting the return on his investments. Gold, which strengthened significantly in 2018, managed to consolidate its position in a landscape where stocks and bitcoin decreased.

Although Russia and China continued to buy large amounts of gold, prices continued to drop in 2018. However, as of today, gold is very close to breaking its all time high.

Will bitcoin follow?

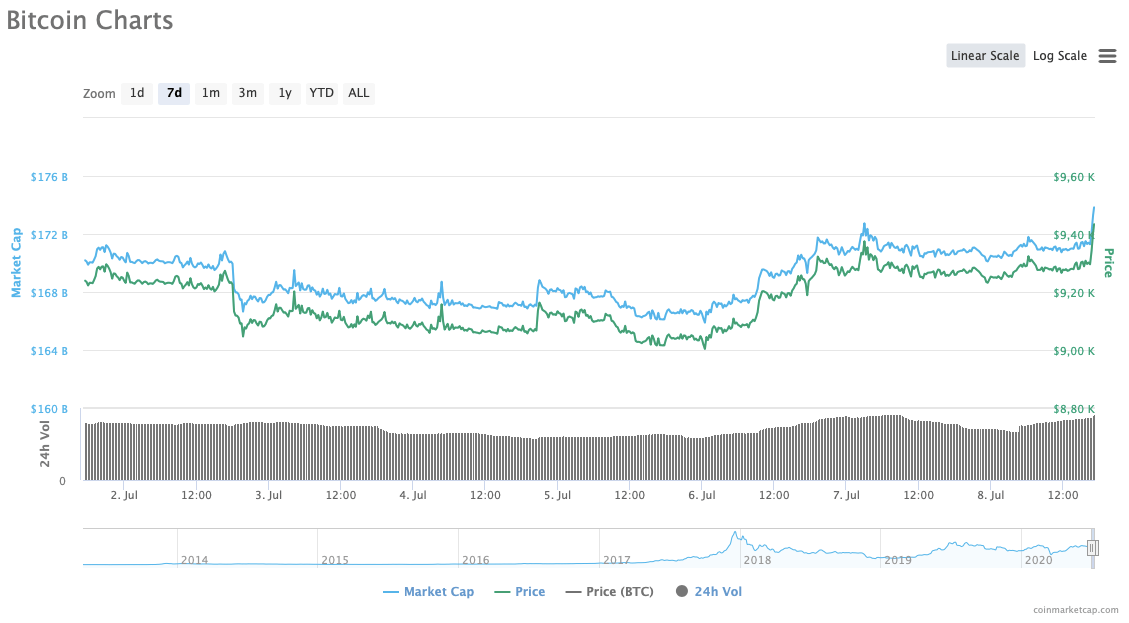

Whether bitcoin will follow this trend is a big curiosity. Cryptocurrency, which is referred to as digital gold due to its limited supply, is seen as a safe investment tool even though it has recently been parallel with stocks.

Bitcoin price has been sideways for a while, but some analysts think the price will move up soon. If gold breaks a new record this can trigger a rise for bitcoin.

Also, more money flowing into the market, regardless of gold, fiat or bitcoin, can lead to an increase in asset prices. Nowadays, when the COVID-19 pandemic stops life, individuals’ trust in the banking system in many countries is also decreasing.

For example, financial systems in Lebanon collapsed, inflation in Argentina is flying. Other economically weak countries are also facing economic difficulties. This can cause money to flow to assets outside the banking system such as bitcoin and gold.